House Prices Keep Rising After a Bumper Year for Sellers

House prices are predicted to keep going up after 12 months of hitting record highs. The average home put on £27,000 of value last year and now costs just under £274,712. But estate agents fear that the fast-rising market is leaving behind first-time buyers. Another...

Notice Periods for Wales From 25 March 2022

We are not aware of an official announcement, but we understand that from 25 March 2022, notice periods in Wales will revert to pre-pandemic levels like England already have. The length of notice will revert to two months for section 21 and 14 days for section 8 rent...

Landlords Get a Chance to Talk Tax With Policy-Makers

Now is your chance to have a say about making property and landlord tax simpler and less taxing. The government’s tax boffins want landlords and property professionals to tell them how they think the landlord taxes should change. The plea comes from the Office of Tax...

Sunak Pledges Tax Cuts on the Way for Landlords in Spring Statement

Landlords will pay less tax, promises Chancellor Rishi Sunak in his Spring Statement 2022 - but must wait for up to two years for the cut to take full effect. The Chancellor announced several tax measures covering landlords and holiday let owners during his 45-minute...

Mortgage Trap for Cladding Crisis Landlords

Thousands of landlords renting out buy to let apartments face huge bills to pay for the stripping of unsafe cladding from blocks of flats. Experts fear landlords may become rent and mortgage prisoners due to cladding and other fire safety issues blighting the homes....

Council Tax Triples for Holiday Home Landlords (Wales)

Holiday lets and second homeowners face a 300 per cent council tax rise from April 2023 as the Welsh Government tries to make more affordable homes available to locals. According to official figures, 23,000 homes in Wales stand empty for most of the time as second...

What to Do if Your Letting Agent Goes Bust

Yet another letting agent has closed, leaving hundreds of landlords and tenants in financial difficulties. Based in High Street, Kings Langley, Hertfordshire, Pendley Estates has closed and appointed insolvency experts to handle a voluntary creditors liquidation....

Buy to Let Rents Rise at the Fastest Rate for Five Years

Buy to let rents across the country are rising at the fastest rate for five years, according to the latest official data. A scarcity of homes to let and a rising number of prospective tenants looking for a property have combined to push up rents. Outside London, rent...

Rent Controls Pledge From Minister

A short, terse statement from the government has cleared up policy on rent controls for landlords in England. The statement was from housing under-secretary Eddie Hughes in response to a written question from Labour MP Rachael Maskell, who asked if his...

Face-to-Face Training for Renting Homes Act (Wales)

Training for Professionals is to provide face-to-face training in various parts of Wales during April 2022 for the new Renting Homes (Wales) Act. As most will already know, we work closely with Training for Professionals. For example, we are working with them to...

Coronavirus: Guidance for Landlords and Letting Agents

Stats above are for UK only and refreshed daily. Coronavirus COVID-19 Pandemic Hub for Landlords and Letting Agents For the latest #StayAlert guidance, please see the.gov coronavirus page here. Landlord Specific Guidance Possession Notices...

Right to Rent Coronavirus Rules Extended

In England, since 30 March 2020, the right to rent guidance has been amended to allow for checks to be carried out in ways other than face to face. The guidance has been further extended until 31 August 2021 5 April 2022 30 September 2022. From 1 October 2022, checks...

Landlords Targeted In Data Security Crackdown

A data security crackdown has started on landlords who collect, store and use the personal information of tenants without registering with the data protection watchdog. Warning letters are winging their way to thousands of property letting businesses. The letters urge...

Rogue Landlords – a Look at the Stats

It seems landlords aren’t the rogues, swindlers, and crooks that politicians and councils paint them. After overhauling property laws countless times in recent years, the statistics don’t match the claims. The government spin is around 10,500 rogue landlords are...

Tenancy Builder Updated With New Electronic Signing

We have introduced a couple of major updates to the Tenancy Builder. The first is that there is a new integrated digital signing provider offering improvements. Second is that the guarantor forms have been updated by removing the witness element. Digital signing...

Renting Homes Wales Act Webinar – 24 February 2022

Training for Professionals will be presenting a live webinar covering the much talked about Rented Homes (Wales) Act 2016 on the 24th February 2022 @ 14.00. The Renting Homes (Wales) Act 2016 is the most significant piece of legislation ever passed for housing by the...

Soaring Cost of Living Sparks a Rent Squeeze

Landlords are riding an economic rollercoaster as the cost of living, house prices and rents are shooting through the roof. The Bank of England has just doubled the official interest rates to 0.5 per cent, the highest level since March 2018. Although doubling the rate...

Gove Sets Levelling Up Mission for Landlords

Boris Johnson’s troubled government has unveiled a flagship levelling up white paper setting out plans to spread wealth and opportunity across the country. The white paper covers 12 missions intended to move power and money away from Whitehall to local leaders. One of...

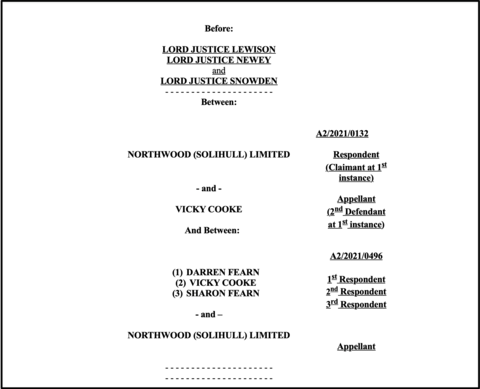

Company Signing – Northwood Case

The decision of Northwood (Solihull) Ltd v Fearn & Ors [2022] EWCA Civ 40 has been handed down, and it's good news for landlords and agents alike. Background (High Court) In the Northwood case at the High Court (our report included in this article), it was held...

HMRC Shifts Self-Assessment Filing Deadlines

Landlords have some breathing space to pay their self-assessment tax thanks to HM Revenue & Customs giving extra time before late payment penalties kick in. The grace period is because HMRC recognises the coronavirus pandemic's pressure on businesses and their tax...